Understanding Mutual Funds: A Simple Guide

If you’ve ever wondered about investing but felt overwhelmed by complex jargon and technical terms, mutual funds might be a great place to start. Let’s break down what mutual funds are and why they could be a smart choice for your investment strategy.

What Are Mutual Funds?

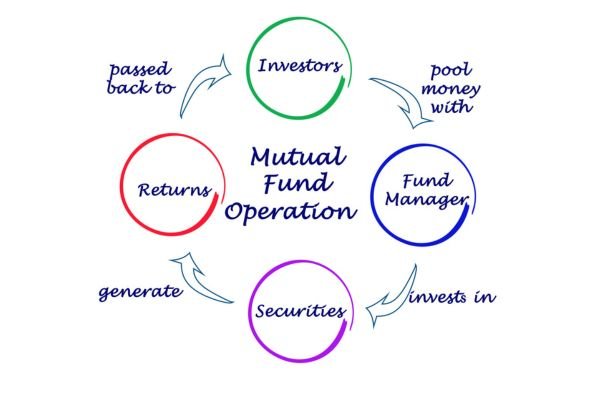

Think of mutual funds as a big pot where many investors pool their money together. This pooled money is then used by professional managers to buy a diversified mix of investments, such as stocks, bonds, or other assets. By combining resources, investors can gain access to a broader range of investments than they might be able to on their own.

How Do Mutual Funds Work?

- Pooling Money: When you invest in a mutual fund, you buy shares of the fund. Your money is combined with the money from other investors.

- Professional Management: A fund manager uses this pooled money to invest in a variety of assets based on the fund’s investment objective.

- Diversification: Instead of putting all your money into one stock or bond, your investment is spread across many different assets, which can help reduce risk.

- Returns and Risks: The returns you earn depend on how well the fund’s investments perform. Similarly, the risks are tied to the assets the fund holds.

Types of Mutual Funds

- Equity Funds: These invest primarily in stocks and aim for growth. They come with higher risk but the potential for higher returns.

- Bond Funds: These invest in bonds and are generally considered safer than equity funds. They provide regular income through interest payments.

- Money Market Funds: These invest in short-term, low-risk investments like Treasury bills. They offer lower returns but are very safe.

- Balanced Funds: These invest in a mix of stocks and bonds, aiming to balance risk and return.

Why Consider Mutual Funds?

- Professional Management: You don’t need to be an expert in picking investments. Fund managers do the research and make decisions on your behalf.

- Diversification: Investing in a mutual fund gives you access to a wide range of investments, helping to spread risk.

- Accessibility: Many mutual funds have relatively low minimum investment amounts, making them accessible to most investors.

- Liquidity: You can buy or sell mutual fund shares relatively easily, providing flexibility.

Things to Watch Out For

- Fees: Mutual funds come with various fees, including management fees and sometimes sales charges. Be sure to understand these before investing.

- Performance Variability: Past performance does not guarantee future results. Different funds have different risk profiles and performance histories.

- Fund Objectives: Make sure the fund’s goals align with your own financial goals. For instance, if you’re saving for retirement, you might want a fund that focuses on long-term growth.

Final Thoughts

Mutual funds are a versatile investment option that can fit a variety of financial goals and risk tolerances. They offer the benefit of professional management and diversification, which can be especially helpful for new investors. As with any investment, it’s important to do your research and consider how a mutual fund fits into your overall financial plan. Happy investing!