The Power of SIPs: Why Systematic Investment Plans Are a Smart Choice

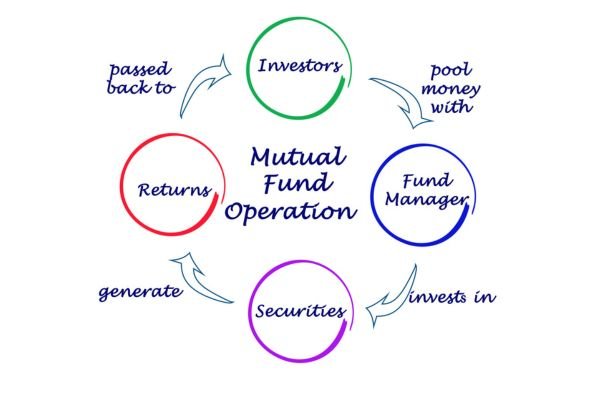

The Power of SIPs: Why Systematic Investment Plans Are a Smart Choice When it comes to investing, consistency and discipline are key to achieving long-term financial goals. One of the most effective ways to build wealth steadily is through a Systematic Investment Plan (SIP). SIPs are a popular investment approach that offers numerous benefits for investors looking to grow their savings over time. Here’s why SIPs are an excellent choice for your investment strategy. What is a Systematic Investment Plan (SIP)? A Systematic Investment Plan (SIP) allows you to invest a fixed amount of money at regular intervals, such as monthly or quarterly, into a mutual fund. Instead of making a lump-sum investment, SIPs spread out your investments over time. This disciplined approach helps in averaging out the purchase cost of mutual fund units, potentially reducing the impact of market volatility. Why SIPs Are Important SIPs promote a disciplined investment approach by encouraging regular contributions. By committing to invest a fixed amount regularly, you develop a habit of saving and investing consistently. This discipline is crucial for building wealth over the long term, as it ensures that you’re regularly contributing to your investment goals. One of the most significant advantages of SIPs is rupee cost averaging. By investing a fixed amount regularly, you buy more units when prices are low and fewer units when prices are high. This strategy helps average out the cost of your investments over time, reducing the impact of market fluctuations and potentially enhancing returns. SIPs leverage the power of compounding, where the returns on your investment generate additional returns over time. Regular investments in a mutual fund allow your money to grow consistently, and the compounding effect accelerates wealth accumulation. The earlier you start, the more you benefit from compounding, making SIPs a powerful tool for long-term financial growth. SIPs are accessible to a wide range of investors due to their affordability. You can start with a relatively small amount, making it easier to begin investing regardless of your financial situation. Additionally, SIPs offer flexibility in terms of the investment amount and frequency. You can adjust your SIP contributions or frequency based on your financial goals and circumstances. Investing a fixed amount regularly helps mitigate the effects of market volatility. Instead of trying to time the market, which can be challenging and risky, SIPs provide a systematic approach that averages out your investment cost. This approach helps reduce the impact of short-term market fluctuations and minimizes the risk associated with market timing. SIPs are well-suited for long-term financial goals, such as retirement planning, education funding, or buying a home. By committing to regular investments over an extended period, you can accumulate a substantial corpus to achieve your financial objectives. The discipline and consistency of SIPs align well with long-term planning and wealth-building. SIPs offer convenience through automated investments. Once you set up an SIP, the amount is automatically debited from your bank account and invested in the mutual fund of your choice. This automation eliminates the need for manual transactions and ensures that you stay committed to your investment plan. Final Thoughts Systematic Investment Plans (SIPs) provide a disciplined, flexible, and efficient approach to investing in mutual funds. By investing regularly, taking advantage of rupee cost averaging, and leveraging the power of compounding, SIPs offer a practical path to achieving long-term financial goals. Whether you’re saving for retirement, education, or other major milestones, SIPs can help you build wealth steadily and systematically. Embrace the power of SIPs and take control of your financial future with a smart, disciplined investment strategy.